Profit in Lieu of Salary: How to Avoid Paying Extra Tax

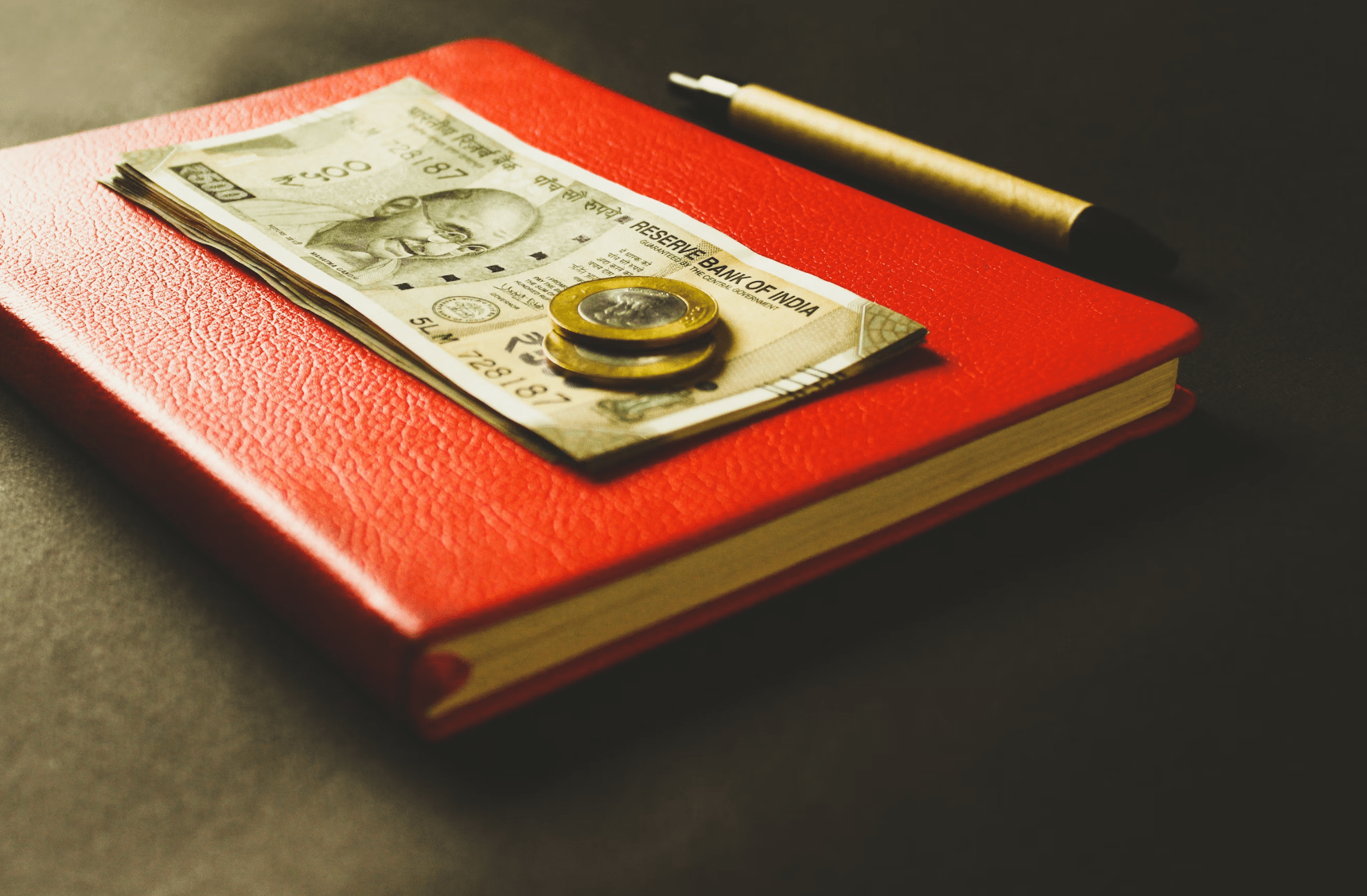

Imagine receiving a sudden one-time payment from your employer. It could be compensation for leaving your job, a retirement benefit, or a special bonus. Naturally, you might wonder, “Do I have to pay tax on this?” This is where profit in lieu of salary comes into play. It often appears in salary statements, Form 16, and income tax discussions, but many employees and students of HR or accounting overlook its importance. Understanding it is crucial because it affects both your tax liability and your financial planning.

What Is Profit in Lieu of Salary?

It can refer to any payment or benefit linked to your employment that is not part of your regular monthly salary. Even if it is a one-time payout, such as termination compensation or retirement benefits, it is taxable under Section 17(3) of the Income Tax Act. Essentially, it bridges the gap between your regular earnings and special employment-related payments.

An Example to Make It Simple

For example, Rahul earns ₹50,000 per month. One day, his company terminates his employment and pays him ₹2,00,000 as compensation for job loss. This payment is not part of his regular salary, but it is linked to his employment. As a result, it is considered profit in lieu of salary and becomes taxable, except where exemptions apply. This example shows that even one-time payments can have significant tax implications.

Types of Payments Included In Profit In Lieu Of Salary

The Income Tax Act lists several payments that fall under this category. These include termination compensation, gratuity, ex-gratia payments, special bonuses, amounts from unrecognized provident funds, keyman insurance policy payouts, and voluntary retirement scheme (VRS) payments. In short, if the money arises because of your employment, it is taxable under salary income, even if it does not arrive monthly.

Exemptions and Tax Relief

Not all payments classified as profit in lieu of salary are fully taxable rather the Income Tax Act provides exemptions to reduce the burden. For instance, Section 10(10) allows limits on gratuity exemptions. Section 10(10B) provides relief for retrenchment compensation, and Section 10(10C) exempts eligible VRS payments up to ₹5,00,000. Therefore, knowing which section applies can help you avoid overpaying taxes. Reviewing Form 16 and payroll statements carefully is essential before filing your ITR.

Why Profit In Lieu Of Salary Matters

In today’s job market, understanding profit in lieu of salary is more important than ever. Careers are no longer linear. People change jobs, companies restructure, and one-time payouts are increasingly common. Without this knowledge, employees may pay unnecessary taxes or misreport income. On the other hand, awareness allows for smarter financial planning. It helps anticipate tax liabilities, maximize exemptions, and use one-time payments strategically instead of treating them as windfalls.

Making It Work for You

Profit in lieu of salary acts as a financial checkpoint. It ensures special payments are correctly captured under taxable income. Moreover, it empowers employees to make informed financial decisions. By understanding which payments are taxable and which qualify for exemptions, you can plan your finances effectively. You can avoid surprises and even align these payments with broader financial goals. Today, knowing how to handle profit in lieu of salary is not just about compliance. It is about achieving financial security and stability.

Frequently Asked Questions (FAQs)

- What is profit in lieu of salary?

It is any payment or benefit received due to employment that does not form part of regular monthly salary but is taxable under Section 17(3). - Are all one-time payments from employers taxable?

Not all. Payments like gratuity, VRS, or retrenchment compensation may qualify for exemptions. - How do I know if my payment is taxable?

Check your Form 16 and payroll statements. Identify which section of the Income Tax Act applies to your payment. - Can students or part-time employees receive profit in lieu of salary?

Yes, any individual linked to employment who receives one-time or special payments may fall under this category. - Why is understanding profit in lieu of salary important?

It helps employees avoid overpaying taxes, plan finances effectively, and use special payments strategically.